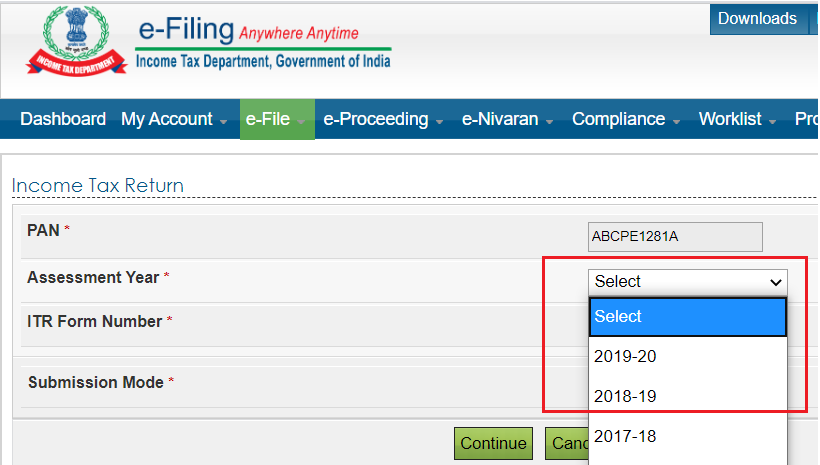

This is for the Taxpayer, and you want to file your tax return for the AY 2020/21 or FY 2019/2020, you cannot do the e-filing now, ITR Form AY 2020-21 is not yet available in e-filing portal and you should wait to do this.

Here the some key points, you should take a note,

Key Points on ITR Form AY 2020-21:

- New Income Tax Return – ITR forms for AY 2020-21/FY 2019-20.

- IT Department notification delayed to last week of May.

- Tax Return Filing ITR form for AY 2020-21 is not available in the e-filing portal.

- A taxpayer could not file the return until the return filing form utility come.

Detailed Story on ITR Form AY 2020-21

So, The Central Board of Direct Taxes (CBDT) mentioned “There will be new Income Tax Return Forms (ITR) forms for the financial year FY 2019/20 or assessment year AY 2020/21“.

There are following number of ITR forms available ITR 1 Sahaj, ITR 2, ITR 3, ITR 4 Sugam. ITR 5, ITR 6, ITR 7 and ITR-V.

Finance Act, 2019 according to CA club made this amendments, so ITR Form change introduced in AY 2020-21.

In new ITR forms, new Scheduled DI have added to seek the details of the investment, deposits, and payments made during the extended till June 2020.

Income Tax department usually notify this IIR form details by the first week of April itself, but this year, due to some unexpected circumstances, they have only notified about this ITR forms change by last week of May 2020 only.

So, these new ITR forms have not available in the e-filing portal yet, IT department has only notified about the ITR form changes without the return filing form.

https://www.incometaxindiaefiling.gov.in/home

Thus, a taxpayer who is looking to file the return should wait to do, until the return filing form option available in the e-filing portal.

Also, Kapil Rana, Chairman and Founder, HostBooks Limited, said ITR Forms have incorporated few major changes in AY 2020-21 . In ITR-1, Government employees have been bifurcated in State, Central Government, and a new type as “NA” added to the list. Also, ITR return forms have the information like deposit more than Rs 1 crore in the account, foreign travel spending more than Rs 2 lakh, expenses in electricity more than Rs 1 lakh and a statement for amount investment/ deposited/ payment made during the period from 01/04/2020 to 30/06/2020.”

Other Notable changes

Other some noticeable changes are new Schedule DA. This has added to provide investment deposited/payment on above period. PAN made optional, if Aadhar number provided in ITR 4.

In section 44AD, New clause electronic mode has added and reduced the presumptive income from 8% to 6%.

In section 44AE, added new validation which is number of vehicles should not exceed 10 vehicles at any time during the year.

ITR Forms explained who need to file which ITR Forms

ITR 1 Sahaj

- Individual residents who is having total income below Rs 50lakh.

- Having Incomes from the salaries, one house property, other sources like interests and agriculture income upto Rs 5000.

- Not for an individual who is either a director in a company or has invested in unlisted equity shares

ITR 2

- Individuals and HUFs (Hindu Undivided Family) who is not having income from profits and gains of business or profession.

ITR 3

- Individuals and HUFs (Hindu Undivided Family) who is having income from profits and gains of business or profession.

ITR 4 Sugam

- This is for individuals, HUFs and Firms (other than LLP) being a resident having a total income upto Rs 50 lakh and having income from business and profession which is computed under sections 44AD, 44ADA or 44AE.

ITR 5

- For persons other than (i) individual, (ii) HUF, (iii) company and (iv) person filing Form ITR-7.

ITR 6

- For Companies other than companies claiming exemption under section 11.

ITR 7

- For persons including companies required to furnish return under sections 139(4A) or 139(4B) or 139(4C) or 139(4D) only.

I hope this article, helps to taxpayer who is looking to file the taxt return for the Assessment Year AY 2020/21 or Financial Year 2019/201